Planned Giving and Legacy Gifts

Leave a Lasting Legacy

Giving, serving and planning for the future make for good stewardship. A planned gift to Episcopal Relief & Development allows you to help save lives and transform communities while maximizing your financial benefit.

Planned Giving

Learn About the Matthew 25 Legacy Society

Our Matthew 25 Legacy Society is a group of donors who sustain our work to save lives and transform communities through planned gifts such as bequests, life income gifts and charitable trusts.

Meet Some of Our Planned Giving Donors

Planned giving donors have the opportunity to support Episcopal Relief & Development’s work while also meeting their individual financial needs. Read some of their stories here.

Learn How You Can Become a Planned Giving Donor

By making a planned gift, you ensure that Episcopal Relief & Development can continue its critical work for years to come. In addition, some planned gifts provide income during your lifetime, while others help transfer assets and reduce or eliminate tax burdens. Our staff can help you understand all of your options. Please contact us to learn more at plannedgiving@episcopalrelief.org or 855.312.4325.

Bequests and Wills

One of the simplest and most common ways to make a planned gift is by naming Episcopal Relief & Development in your will. A bequest is a meaningful way to support our work without affecting cash flow during your lifetime.

Please be sure to consult with your financial advisor and/or your attorney when you prepare a will, revise a will, or add a codicil. Here is a helpful file to download as you prepare to write your will: DOWNLOAD PDF.

There are several types of bequests and we provide sample language for the various options:

- A specific bequest indicates the amount of cash, securities or other asset you wish to leave to Episcopal Relief & Development. Or it can indicate a specific percentage of the total value of your estate.

- A residuary bequest leaves the remaining portion of your estate (or a percentage of the total) after all other bequests have been satisfied.

- You can make Episcopal Relief & Development the recipient of a contingency bequest, which takes into account the possibility of a change in your beneficiary’s circumstances.

Specific Bequest

You can make a bequest to Episcopal Relief & Development for a specific dollar amount or percentage of your estate:

I give, devise and bequeath to Episcopal Relief & Development the sum of $________ as an unrestricted gift, to be used at the sole discretion of Episcopal Relief & Development.

Or, you can make a bequest for specific assets, such as securities, real estate or personal property. Please be as specific as possible in identifying the property:

I give, devise and bequeath to Episcopal Relief & Development my [insert description of the asset], to be used and/or disposed of, as the Episcopal Relief & Development determines for its general purposes.

Residuary Bequest

You can make a residuary bequest, which gives all or a portion of the residue of your estate to Episcopal Relief & Development after payment of expenses and any amounts designated to other beneficiaries.

I give, devise, and bequeath to Episcopal Relief & Development X percent of the rest, residue and remainder of my estate as an unrestricted gift, to be used at its sole discretion.

Contingency Bequest

You can make a contingency bequest to Episcopal Relief & Development, which allows you to account for a change in your beneficiary’s circumstances.

I give, devise, and bequeath [insert name] X percent of the rest, residue, and remainder of my estate if s/he survives me. If [insert name] does not survive me, I give, devise and bequeath to Episcopal Relief & Development, X percent of the rest, residue, and remainder of my estate as an unrestricted gift, to be used at its sole discretion.

Unrestricted and Restricted Gifts

Gifts that do not restrict the use (unrestricted gifts) allow Episcopal Relief & Development to use these resources where they are most needed. Episcopal Relief & Development is also grateful for gifts that are designated for a specific purpose that advances its mission (restricted gifts), such as support to a specific initiative or for a specific program.

If you are interested in making a restricted gift, it is important that you include language to ensure that Episcopal Relief & Development may re-direct the use of your gift if the specified initiative, program or purpose ceases to need funds in the future:

I give, devise and bequeath to Episcopal Relief & Development the sum of $_____ to be used for the [insert name of program] for so long as Episcopal Relief & Development determines that the need exists. Should the need no longer exist, Episcopal Relief & Development may, in its sole discretion, direct the use of my bequest for a purpose related as closely as possible to that stated above.

Life Income Gifts

One of the most popular planned giving options is establishing a life income gift. This instrument enables you to donate assets while you are still living, and to receive a consistent income stream for the rest of your life. Life income gifts allow you to obtain a charitable deduction for a portion of the gift and to receive an income payment based on various factors including age, type of gift and contribution amount. Age and contribution minimums may apply. Please contact us for more information.

Charitable Gift Annuity

Enables you to make a contribution to Episcopal Relief & Development and guarantee yourself (or a beneficiary) an income for life. The annuity is a contract between the donor and the Episcopal Church Foundation, which guarantees a fixed rate of return or payout rate based on the age(s) of the donor(s) and/or named beneficiary(ies).

Create a Charitable Gift Annuity: DOWNLOAD PDF

Pooled Income Fund

Combines or “pools” a donor’s gift together with others in a diversified investment portfolio managed by a team of financial professionals. You and your designated beneficiaries receive an income for life based on your share of the return on the investments. Upon the death of the final beneficiary, the principal will go to Episcopal Relief & Development.

Participate in a Pooled Income Fund: DOWNLOAD PDF

Charitable Remainder Trust

Sets up a tax-exempt irrevocable trust arrangement in which the donor transfers cash or assets (such as appreciated securities or stock) to the trust and can receive income for life or a term up to 20 years. At the death of the final beneficiary (or end of the term), the remainder will go to Episcopal Relief & Development. There are two types of charitable remainder trusts: the charitable remainder unitrust (CRUT), where the income varies with the value of the trust, and the charitable remainder annuity trust (CRAT), in which the income is fixed based on the initial funding value of the trust. Please be sure to speak with your financial advisor about the best instrument to meet your needs.

Establish a Trust: DOWNLOAD PDF

Other Charitable Gifts

IRA Charitable Rollover Gifts

If you are 70-1/2 or older, you can make a contribution from your IRA simply by instructing your plan administrator to make the transfer directly to Episcopal Relief & Development. You are allowed to transfer up to $108,000 a year to the charities of your choice. Visit this page to learn more.

Charitable Lead Trust

Allows a donor to transfer assets to a trust that pays income (donor/trustees determine the payout rate) to Episcopal Relief & Development for a set term of years. At the end of the term, the remainder transfers back to the donor or heirs. You receive a tax deduction, and the contribution may reduce estate taxes.

Charitable Life Estate Contract

Enables the donor to deed real property to Episcopal Relief & Development while retaining the right to reside in the property while living. You receive a tax deduction and the property may avoid estate taxes and capital gains tax. The contract must specify who pays for maintenance, taxes, insurance and other fees on the property. Vacation property and domiciles may be used, but businesses may not.

Life Insurance

Permits a donor to purchase a life insurance policy and name Episcopal Relief & Development as the owner and beneficiary. You can contribute to Episcopal Relief & Development to pay for the premiums and receive a deduction for the contribution. If you make Episcopal Relief & Development the owner and beneficiary of an existing policy, you get an additional deduction for the current value of the policy.

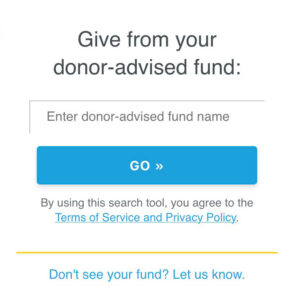

Donor–Advised Funds (DAF)

DAFs are a type of giving program that allows you to combine favorable tax benefits with the flexibility to easily support your charitable giving. An increasingly popular charitable vehicle, DAFs are an excellent way to both simplify and facilitate your strategic philanthropic goals. These are similar to a “charitable savings account” because you can add funds to it whenever you like. Some donors choose to open a DAF rather than creating a private foundation.

Your DAF gift to Episcopal Relief & Development helps support our work in building resilience, fostering economic growth, and promoting health and well-being for children, families and whole communities throughout the world.

How does it work?

- Establish your DAF by making an irrevocable, tax-deductible

donation through a sponsoring charitable organization - Advise the investment allocation of how much and how often

you want to distribute funds (any investment growth is tax-free) - Contact your financial advisor for detailed information