Donor-Advised Funds (DAF)

Maximize your gift with flexibility and tax benefits

A Donor-Advised Fund (DAF) is a simple and strategic way to support causes you care about while enjoying the tax benefits. Similar to a “charitable savings account,” a DAF lets you contribute funds anytime and distribute them whenever you want.

Some donors choose to open a DAF rather than create a private foundation. Your DAF gift to Episcopal Relief & Development helps support our work in:

- Building resilience

- Fostering economic growth

- Promoting health and well-being for communities worldwide.

How it works

- Establish your DAF by making an irrevocable, tax-deductible donation through a sponsoring charitable organization.

- Advise the investment allocation of how much and how often you want to distribute funds—any investment growth is tax-free!

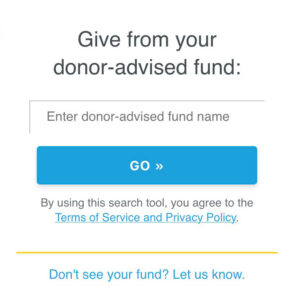

Are you ready to make a long-lasting impact? Contact your financial advisor today for details on setting up or donating through your DAF.